August 30, 2024

Discretionary Count On

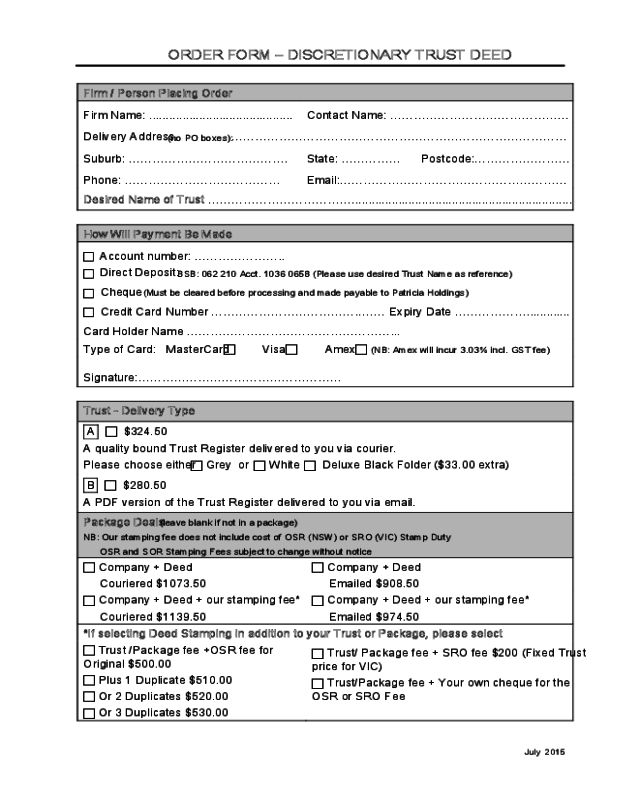

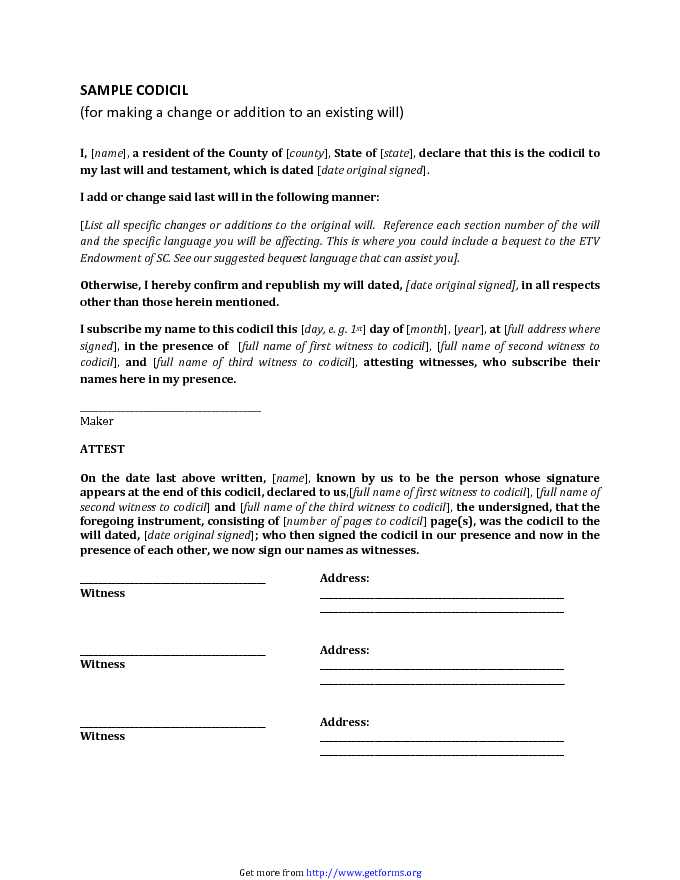

Why Use An Optional Count On? The court held that their optional powers continued, and that they need to exercise it in respect of the dormant years now as they should have done at the time. The court reaffirmed that if trustees refuse to distribute revenue, or refuse to exercise their discretion, although the court could not compel it be worked out in a certain fashion, it could purchase that the trustees be changed. It is important to keep in mind that letters of wishes are not a legally binding paper and for that reason there is no responsibility put on the trustees to follow them. Entering into a count on can be difficult to navigate with the numerous lawful and tax obligation demands. Nonetheless, it can be a very valuable method to handle and safeguard your properties.'Will my family lose £175k tax break if inheritance money goes into a trust?' - The Telegraph

'Will my family lose £175k tax break if inheritance money goes into a trust?'.

Posted: Wed, 22 Feb 2023 08:00:00 GMT [source]

Types Of Optional Trusts Offered From Quilter

Nonetheless, in instances where a settlor is additionally a recipient, the recipient might be tired on any income developing to the trustees. A discretionary depend on can be produced when the settlor is alive, or in their will. Discretionary counts on can seem unusual on the face of it yet there are many reasons that they might be a vital part of your estate planning. The ATO refers to Counts on as "a specifying function of the Australian economic climate" and has estimated that by 2022 there will certainly be over 1 million Rely on Australia.Requesting Information From Trustees

An economic advisor can assist you arrange via the myriad of estate planning choices. Inevitably the purpose is to minimise IHT on death but, maybe a lot more significantly, pass properties to the future generation through a depend on as opposed to outright. Every one of these trust funds will accomplish the last and International Assets and Laws the level of IHT efficiency relies on the alternative chosen. The settlor can give up or delay accessibility to capital repayments if they want, so they can attain their objectives without needing to make irreversible decisions about their own future financial requirements. The gift into the Way of living Depend On is a Chargeable Lifetime Transfer for IHT objectives and if the settlor were to die within severn years of proclaiming the count on the the gift stays part of the estate for IHT purposes. There is additionally an impact when gifts are made in this order, any stopped working Pet dogs come to be chargeable and impact the computation at the periodic/ 10 annual fee.Understanding Optional Beneficiaries

If the settlor dies within 7 years of making the gift right into optional trust, there may be more tax to pay. The gift is measured versus the settlor's NRB offered at fatality and if this is gone beyond an estimation is done based upon the full fatality price of 40%. A discretionary count on is a flexible automobile for protecting assets and maintaining control of just how and when they are dispersed while potentially safeguarding them from the fatality rate of Estate tax. With the right structuring, an optional trust can be easy to provide and tax-efficient. The administrators will not have the ability to make use of taper alleviation as the present was made within 2 years of death. First of all we require to recalculate the price billed at the 10 year wedding anniversary, using the present NRB at the date of departure which is assumed as ₤ 406,600. Any type of car loan from the trust to a recipient should be documented appropriately and by way of a. lending contract. This could additionally be utilized to preserve funds for a minor till they get to an age where they can take care of the cash on their own. Where the beneficiary is additionally a trustee, we would certainly advise another trustee is designated who is entirely neutral to avoid any kind of problem of rate of interest. Discretionary Trusts vary from Life Interest Depends on due to the fact that no automated right to the satisfaction of the income or funding of the trust fund develops. Bear in mind, this is an unalterable trust so the transfer of possessions is long-term. So it is necessary to make sure in advance that this sort of depend on is proper for your estate planning needs. It might be handy to talk about other trust options with an estate preparation lawyer or a financial consultant before moving ahead with the production of a discretionary count on. This kind of optional trust fund includes the settlor as one of the recipients of the depend on residential or commercial property. Placing the assets in a discretionary trust secures a recipient's share where they are financially unstable. Because under a discretionary count on, no person beneficiary can be claimed to have title to any count on possessions prior to a distribution, this made optional counts on a powerful weapon for tax organizers. In the United Kingdom, for example, the Financing Act 1975 enforced a "capital transfer tax" on any kind of residential property picked a discretionary count on, which was replaced in the Money Act 1988 by the inheritance tax. Having an optional trust fund allows a person to be able to keep their assets without the duty of being the lawful owner. Firms are required to pay revenue tax for their net income each financial year. However, an optional count on generally does not pay earnings tax obligation, and rather, the recipients pay taxes on their own share to the earnings of the trust. In family depends on, the trustee is able to distribute properties to lower the total tax obligation paid by the family.- The trustees can choose which of the recipients get a distribution, how much they receive and when they receive it.

- This allows the trustee to have discretion over who can benefit from the trust and the amount of money each recipient would get yearly.

- It is possible for the settlor to be selected as the guard of the count on.

When to make use of discretionary count on?

An optional depend on divides ownership from control. Ownership by the trustee for the beneficiaries of the family trust fund maintains properties out of injury''s means from any type of cases against an individual. This is also where the individual may, as director of the trustee business, regulate the trustee!

Social Links