August 7, 2024

Revocable Count On Vs Irreversible Count On: What's The Difference?

Pour-over Wills Jacksonville Estate Planning Lawyers Legislation Workplace Of David M Goldman As an example, in Santa Clara, California, they usually amount to 4% to 7% or more of the worth of the estate. Team lawful strategies are provided by MetLife Legal Plans, Inc., Cleveland, Ohio. In California, this entity runs under the name MetLife Legal Insurance policy Providers. In certain states, team legal strategies are supplied through insurance policy protection underwritten by Metropolitan General Insurance Company, Warwick, RI. For expenses and total details of the protection, call or compose the business.Best Online Will Maker - Money

Best Online Will Maker.

Posted: Fri, 11 Nov 2022 08:00:00 GMT [source]

This Preferred Kind Of Will Goes Hand-in-hand With A Living Trust

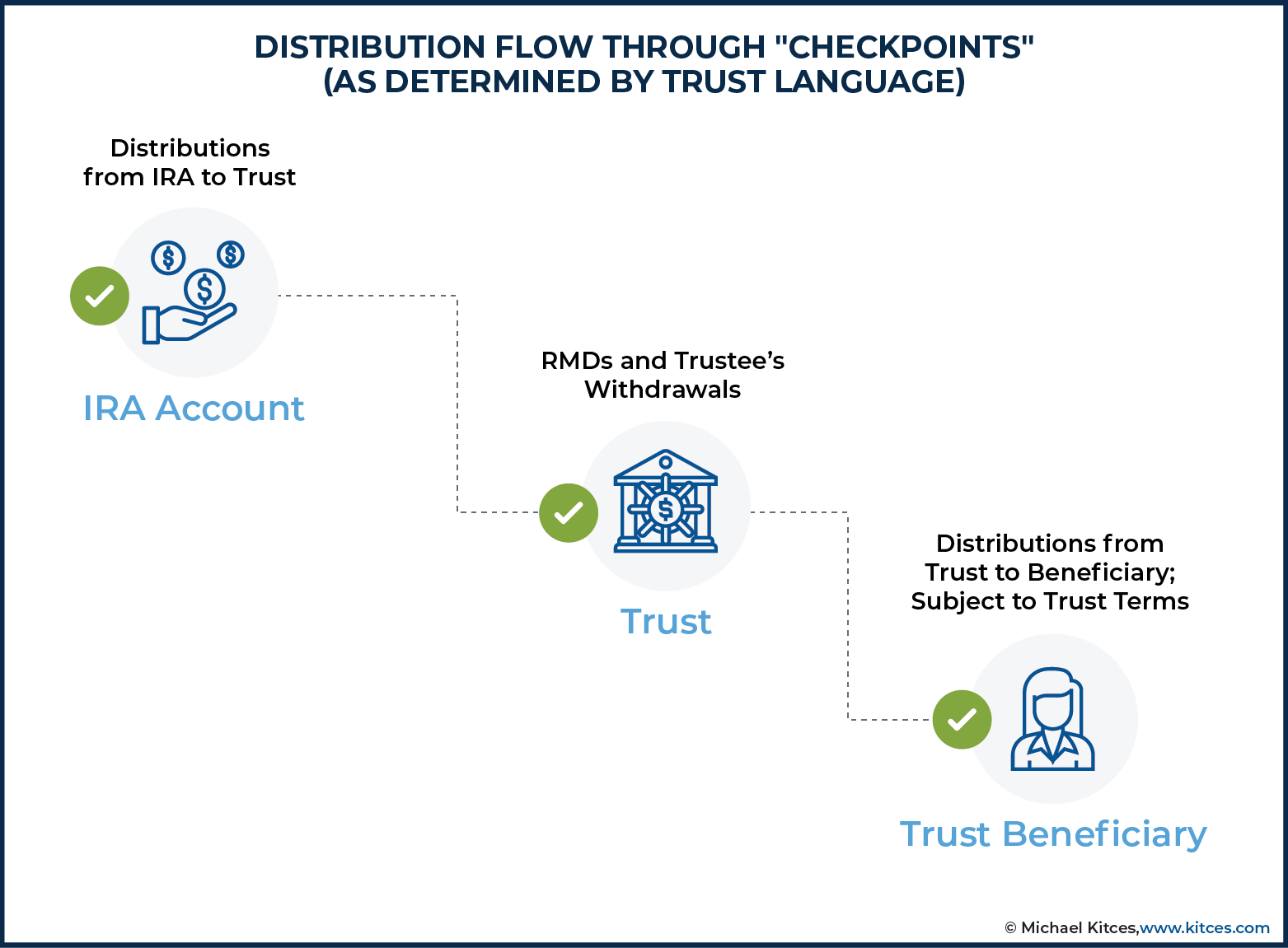

This Will ensures that the personal agent will certainly move any kind of property, not already positioned in the depend on, right into the depend on. This makes sure just a single paper controls your residential property, and Learn more here additionally serves as a catchall in case, not every possession is represented in the count on. It is beneficial to move as many properties as possible into your living count on so they can avoid probate. A pour-over will certainly need to just capture the possessions that slip via the cracks. The main disadvantage of utilizing a pour-over will along with a living depend on is that properties captured by the will needs to go through the standard probate process. Every so often, properties are not transferred properly from the private to the trust.What Is A Put Over Will In A Living Depend On?

- A pour-over will should just record the possessions that slide via the splits.

- A pour-over will is a type of will certainly with a provision to "pour" any type of surplus or unallocated possessions in an individual's estate into a living depend on when the person dies.

- It is much more common for the guarantor to be a trustee or the trustee of a revocable trust.

We And Our Companions Process Data To Provide:

Trust funds can supply tax benefits, privacy and several other advantages that Estate Preparation experts view as important and rewarding. If you just have a basic Will (rather than a Pour Over Will), any assets in there would certainly not have the ability to reap the benefits that Living Trust fund assets do. A joint pour-over trust holds you and your spouse's jointly had property and accounts. You and your partner work as co-trustees of the trust and take care of the home and accounts. There are some key distinctions in between a revocable and an irrevocable count on beyond that a revocable trust fund can be modified however an irreversible trust fund can not be transformed. A pour-over will certainly is a kind of will certainly with an arrangement to "put" any type of extra or unallocated assets in a person's estate right into a living trust when the person dies. The idea is to minimize the probate process and make certain that possessions are dispersed as the dead wishes. Allow's say you have two youngsters and 4 grandchildren to whom you want to leave all of your possessions after you are gone.Who is behind the pour over?

Social Links